VPTrade.com Expands Reach: Innovative Trading Platform Now i...

Seizing a new era of growth, South Africa’s VP Trade Broker is now pioneering the extension of its cutting-edge financial technology services to unexplored markets, embracing global impact opportunities with open arms. Cape Town, Cape Town, South Africa, 30th Jan 2024, King NewsWire – VPTrade.com, a leading online trading platform headquartered in South Africa, has announced its expansion into the Latin American and Asian markets. This strategic move marks a significant milestone for the company, as it brings its cutting-edge financial trading solutions to a broader audience. Underpinned by a robust regulatory framework and operated by a reputable financial services provider, Libra Wealth (PTY) Limited, VPTrade.com has earned its reputation as a trusted partner in the financial world. VPTrade.com spokesperson Moiz expressed enthusiasm about the expansion: “Our entry into Latin America and Asia is more than just a business move; it’s about connecting diverse cultures through the universal language of finance. We are committed to providing our clients with a secure, transparent, and efficient trading experience, no matter where they are in the world.” VPTrade.com is equipped with advanced trading features such as swift withdrawals, tight spreads, rapid execution, and an array of educational and analytical tools. These features, combined with a user-friendly interface, make it an ideal choice for both seasoned and novice traders. The company places a strong emphasis on security and transparency, core values that resonate with its growing international clientele. This platform brings a wave of positive news to users in South America and Asia. By extending the advanced financial technology services to these regions, the platform aim to empower local traders and investors with access to global markets, providing them with invaluable opportunities for diversification and wealth creation. South American and Asian users can now benefit from their secure and transparent trading platform, enabling them to seize international investment prospects with ease. This not only enhances their financial well-being but also strengthens the economic ties between these regions and the rest of the world, fostering greater global collaboration and prosperity. About VPTrade.com: VPTrade.com, operated by Libra Wealth (PTY) Limited, is a Cape Town-based online trading platform regulated by the South African Financial Sector Conduct Authority (FSCA). Committed to providing a secure and user-friendly trading experience, VPTrade.com serves a global clientele with a diverse range of financial trading options. Media Contact Organization: LIBRA WEALTH (PTY) LTD Contact Person: Christiaan Louw Website: https://vptrade.com/ Email: Send Email Contact Number: +27129800608 City: Cape Town State: Cape Town Country: South Africa Release Id: 3001249333 The post VPTrade.com Expands Reach: Innovative Trading Platform Now in Latin America and Asia appeared first on King NewsWire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

Travel: Visatouk Launches Seamless Visa Service for Global C...

United Kingdom, 4th Jan 2025 - Visatouk, a pioneering online visa service provider, has unveiled its innovative new platform designed to streamline the visa application process for citizens across the globe. The company offers a cutting-edge, user-friendly visa service that caters to travelers from a diverse range of countries, including Hong Kong, Macao, Costa Rica, Guyana, and Israel. With its focus on providing seamless and efficient visa processing, Visatouk ensures that every applicant enjoys a smooth experience from start to finish.UK Visa For HONG KONG CITIZENSUK Visa For MACAO CITIZENSUK Visa For COSTA RICAN CITIZENSUK Visa For GUYANESE CITIZENSUK Visa For ISRAELI CITIZENSVisatouk's online visa service allows users to apply for various types of UK visas from the comfort of their homes. Whether you are a Hong Kong citizen seeking a UK visa or a Costa Rican traveler eager to visit the UK, Visatouk simplifies the process, saving valuable time and reducing unnecessary stress. The platform offers comprehensive guides, step-by-step instructions, and 24/7 customer support to ensure applicants are never left in the dark.Instant Online Application: Applicants can easily apply for a UK visa from any location at any time, without the need to visit an embassy or consulate in person.Tailored Services for Different Citizens: Visatouk offers specific solutions for UK visas for Hong Kong citizens, Macao citizens, Costa Rican citizens, Guyanese citizens, and Israeli citizens, ensuring that the unique requirements of each country are met.Efficient Processing Times: With Visatouk’s expedited services, applicants can expect faster processing times compared to traditional visa applications, helping them secure travel plans without delays.Comprehensive Visa Information: The website features detailed and up-to-date information on the specific visa requirements for each country, making it easy to find the most relevant options.About VisatoukVisatouk is a leading provider of online visa services dedicated to making international travel easier and more accessible. With a focus on technology and customer service, the company has streamlined the visa application process for travelers from around the world. Whether you are applying for a UK visa for Guyanese citizens or an Israeli visa, Visatouk’s platform ensures a smooth and stress-free experience. Media Contact Organization: visatouk Contact Person: Manish Rao Website: https://www.visatouk.org/visa Email: Send Email Contact Number: +446657676900 Country:United Kingdom Release id:22285

Professional Commercial Cleaning Services for a Spotless Bus...

Experience professional cleaning that makes a difference. Our commercial cleaning services are designed to keep your business premises pristine and welcoming, ensuring a healthy environment for employees and clients alike. London, United Kingdom, 24th Oct 2024 - Is your workspace lacking the cleanliness it deserves? At PL Commercial Cleaning Services, we specialise in providing commercial cleaning services that ensure your business premises are immaculate and inviting.A clean environment not only creates a positive impression but also boosts employee productivity and well-being. Our comprehensive range of services includes regular office cleaning, deep cleaning, and specialised sanitation. We cater to businesses of all sizes, customising our solutions to meet your specific needs and budget.What sets PL Commercial Cleaning Services apart? Our team is fully trained and insured, using the latest cleaning techniques and eco-friendly products to deliver outstanding results. You can count on us to maintain the highest standards of cleanliness and hygiene in your workplace.Don’t let a messy environment hinder your business. Contact us today to see how our commercial cleaning services can transform your workspace. Visit PL Commercial Cleaning Services to learn more and request a quote.About PL Commercial Cleaning ServicesPL Commercial Cleaning Services is a trusted provider of professional cleaning solutions in the UK. Our mission is to help businesses maintain clean and safe environments, promoting productivity and customer satisfaction. Media Contact Organization: PL Commercial Cleaning Services Contact Person: Deepak Shukla Website: https://plcommercialcleaningservices.co.uk/ Email: Send Email Contact Number: +442071833436 Address:Kemp House, 152 – 160 City Road London, EC1V 2NX City: London Country:United Kingdom Release id:18924

Award-Winning AVANA Companies, a global ecosystem of B2B fun...

Manama, Bahrain, 6th Aug 2024 - AVANA Companies, the multi-award winning global ecosystem of B2B funding and FinTech, are excited to announce their foray into the Kingdom of Saudi Arabia (KSA), with the upcoming launch of www.Ezdaher.sa, with a focus on Shariah-compliant B2B funding for hotel projects. Phase one of the launch encompasses SAR22MM Foreign Direct Investment (FDI) to directly fund the hospitality and SME sectors through www.Ezdaher.sa. This initiative leverages AVANA Companies’ extensive 22 years of finance experience globally, specializing in Commercial Real Estate Funding, mainly in the Hospitality sector. AVANA Companies, focus on innovation and technology, was recently recognized with the award for “Best Real Estate Investment Platform[1]” in the 2024 Fintech Breakthrough Awards. Other winners in this event include global financial giants like Moody's Credit Report, Experian, and Coinbase. “We are proud to win the Best Real Estate Investment Platform award in the prestigious 2024 Fintech Breakthrough Award. This is a testimony and recognition of the innovative work we have been doing for the last 22 years in stimulating the US economy and creating jobs. We are excited about our new journey with Ezdaher in Saudi Arabia. SAR22MM investment in phase one is the first step in many more to come towards The Kingdom’s Vision 2030.”Sundip Patel, CEO and Founder, AVANA CompaniesThe B2B funding platform, by Ezdaher Financing Company (Ezdaher), is focused on bridging the Kingdom's $250Bn financing gap and supporting the development of 310,000 hotel rooms needed by 2030. This initiative aligns with the goals of the Kingdom's Vision 2030 to promote entrepreneurial growth and local business expansion.The excitement around the launch of Ezdaher is growing in the market with $6MM pre-seed capital already invested. The initial FDI in Ezdaher is just the beginning of more ambitious undertakings towards wider goals under Vision 2030.The upcoming launch of Ezdaher brings decades of global experience of AVANA Companies ecosystem as well as a trusted name in global hotel funding. AVANA Companies has funded over $6.4Bn in projects and supported the creation of more than 5,500 jobs. This includes funding construction of well-known hotel brands such as Hilton, Marriott, IHG, Choice, and Wyndham, among others.AVANA Companies and Ezdaher is led by veteran Investor & founder Sundip Patel, who has over 30 years of investing and funding experience, including 18 years in the Middle East. Follow Ezdaher's journey as more major announcements will be coming soon. For further information on how to be part of this transformative Fintech, visit www.Ezdaher.sa to get in contact.About Ezdaher Financing Company Ezdaher Financing Company (Ezdaher) is a Shariah-compliant fintech platform, specializing in B2B funding for SMEs in Saudi Arabia. We offer fast business funding through our Business to Business (B2B) Shariah-compliant financing platform, specifically designed to help franchise hotel projects and hotel supply chain SMEs, to help address the $250 billion funding gap in the Kingdom of Saudi Arabia.AVANA Companies has over 22 years of experience funding over $6.4Bn, including major hotel brands like IHG, Accor, and Hilton. Ezdaher leverages the extensive award-winning knowledge and experience of AVANA Companies.Presently registered with the Ministry of Commerce (Registration No. 1010887991) Ezdaher has initial approval from the Saudi Central Bank and is currently undergoing the final stages of approval.Coming soon on Android and iOS (subject to appropriate approvals).Stay up to date at www.Ezdaher.saAbout AVANA Companies:The AVANA Family of Companies (AVANA) is dedicated to stimulating local economies and contributing to clean energy development across the United States. Founded in 2002 by brothers Sundip and Sanat Patel, AVANA Companies is a family of funding and investment platforms that serve entrepreneurs and investors. The company’s goal across the investment programs is to empower American small businesses by providing commercial real estate loans that are impactful and socially driven. For investors AVANA Companies provides sound investment opportunities secured by real estate and driven by highly qualified sponsors. AVANA is headquartered in Arizona, USA with regional offices in Bahrain and Saudi Arabia (upcoming). It serves small business owners and investors across the United States, Saudi Arabia and Bahrain. AVANA invests in the communities it serves, creating jobs, stimulating economic growth and contributing to sustainable projects. AVANA is named to the 2021 Inc. 5000 List of America’s Fastest-Growing Private Companies. AVANA Capital, LLC is licensed in California under DBO license number 603K752 and in Arizona under CBK license number 0921662. To learn more, visit www.avanacompanies.com or follow AVANA Companies on LinkedIn.[1] https://fintechbreakthrough.com/2024-winners Media Contact Organization: Media Scene for PR and Translation Contact Person: Husain Naser Website: https://mediascenebh.com/ Email: hnasser@mediascenebh.com Contact Number: +97337701002 State: Manama Country:Bahrain Release id:15320

Sentience Hazard Wins Book of the Earth Award and Other Acco...

United States, 20th Dec 2024, - Alexandru Czimbor’s Sentience Hazard has been awarded the prestigious Book of the Earth Award by Words of the Earth, recognizing its unique fusion of cautionary speculation, anthropological depth, and ecological reverence. This accolade follows the novel’s earlier recognition with the BREW Seal of Excellence and the BREW Fiction Book Excellence Award 2024 for Science Fiction of the Year.Words of the Earth described the novel as "a luminous blend of speculation, intellect, and a poet’s love for Earth’s precious balance," praising its ability to explore humanity’s precarious relationship with artificial intelligence and technology while incorporating themes of ecological awareness and sustainability. The review also noted: “Alexandru Czimbor’s Sentience Hazard plunges into this philosophical mire with an authenticity that rivals contemporary debates on ethics and AI... Czimbor’s richly crafted characters, tensions rooted in present-day dilemmas, and an ending as pensive as it is thought-provoking cement Sentience Hazard as a hopeful, gripping modern parable.”For more details about the award, visit the Words of the Earth website.About the BookSet in the 2050s, Sentience Hazard follows François, a computational neuroscientist caught in the ethical and existential dilemmas surrounding an advanced AI project. Through François’ struggles and global perspectives, the novel explores humanity’s evolving entanglement with machines, ethical responsibility in creation, and a profound reflection on Earth’s fragile beauty. With gripping realism and a touch of humor, Sentience Hazard blends speculative fiction with ecological foresight, inviting readers to consider humanity’s role as caretakers of both technological and natural systems.The book is available through major retailers, including Amazon, and can also be found on Goodreads.About the AuthorBorn in Transylvania, Romania, under Nicolae Ceaușescu’s regime, Alexandru Czimbor draws from a lifetime of global perspectives and experience in academia and the software industry to craft narratives rich in moral complexity and speculative insight. His earlier work, The Soul Machines, won the BREW Fiction Book Excellence Award for Historical Fiction of the Year in 2023. Residing in the United States, Czimbor’s transatlantic roots infuse his stories with profound explorations of humanity’s relationship with technology, ethics, and the environment.For more information or media inquiries, please contact Alexandru Czimbor directly via alexandrucz@yahoo.com.

Liquid Crypto welcomes Blockchain420 as their newest partner

AUSTRALIA, 5th April, 2024 – Liquid Crypto is thrilled to welcome Blockchain420 and their token, The Love Care Coin (TLCC) as its newest strategic partner. Sydney, New South Wales, Australia, 5th Apr 2024 – Liquid Crypto is thrilled to welcome Blockchain420 and their token, The Love Care Coin (TLCC) as its newest strategic partner. TLCC is on a mission to ignite a global revolution by championing free energy solutions and democratizing access to financial independence by empowering the marginalised to pave a way for everyone to thrive. Roberto Benitez, CEO of TLCC, stated, We’re delighted to partner with Liquid Crypto to bring their cutting-edge AI technology to our community. This will allow our community the freedom and flexibility to swap, transfer and stake our TLCC token.” “Liquid Crypto has built their platform with the customer in mind. It offers a suite of user-friendly features to streamline the crypto experience. At its core, it uses intelligent routing powered by AI to automate the entire process finding the most favourable rates for token swaps and fast low cost bridging. This combination empowers users to effortlessly manage their portfolio; buy, swap, and bridge tokens, all within a secure and user-friendly environment.” This strategic alliance between Liquid Crypto and TLCC marks a significant step towards realising their shared vision of making Web3 accessible and easy to use for the public majority, not just experienced crypto users. “We are incredibly excited to welcome TLCC into our ecosystem as we embark on this next phase of growth for Liquid Crypto,” said Choua Lee, Founder for Liquid Crypto. Liquid Crypto has recently relaunched its platform with an improved new look as well as a raft of added features including an industry first, DeFi Insurance. Liquid Crypto’s aggregated onmichain platform provides users with a ‘one stop shop’ to complete all of their transactions knowing they will always get the best market rates. TLCC token is the latest project to be onboarded to the Liquid Crypto DEX, following a raft of leading industry names including, JFIN, OORT Chain and CryptoChefs over the last month. Liquid Crypto’s is poised to welcome an additional 25 prominent projects and blockchains that have already signed up to access an innovative solution for their liquidity, create further token utility, and at the same time, leverage its groundbreaking AI capabilities for their communities. To celebrate the new partnership, TLCC token holders will be able to stake their tokens on the Liquid Crypto platform at: https://app.liquidcrypto.finance/staking and receive a boosted APY of 15% rewards for the next three months, enabling users to earn passive income on their assets. About Liquid Crypto Liquid Crypto is leading the way for the next generation of DeFi. Users can effortlessly complete all of their transactions within the one platform with confidence, knowing they will always be offered the lowest possible rate in the market. Liquid Crypto’s AI enables projects, traders and investors to effortlessly realize outsized returns in an omnichain reality by bridging the gap between CeFi, DeFi, Money Managers and Market Makers. Website | Twitter | Telegram | Discord About TLCC Embrace the future with The Love Care Coin – where finance meets compassion, and every stake is a step towards a brighter, more equitable world. Power for the people with a safe, audited BEP-20 contract, decentralized staking, and stellar tokenomics. Join our revolution in energy and finance. More about TLCC Website | Twitter | Instagram For Media enquiries, please contact: Meagan Henderson, Co-Founder marketing@liquidcrypto.finance https://liquidcrypto.finance/ Media Contact Organization: Liquid Crypto Contact Person: Meagan Henderson Website: https://liquidcrypto.finance/ Email: Send Email City: Sydney State: New South Wales Country: Australia Release Id: 05042410910 The post Liquid Crypto welcomes Blockchain420 as their newest partner appeared first on King NewsWire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

Car Accident Lawyer Houston Launches New Website to Connect...

Houston, Texas, United States, 12th Sep 2024 - Car Accident Lawyer Houston, a leading legal resource for accident victims in the Houston area, has announced the launch of its new website designed to help potential clients easily find and connect with the best car accident attorneys in the city.The new website, caraccidentlawyerhouston.com, features a user-friendly interface that allows visitors to quickly search for qualified lawyers based on their specific needs and circumstances. The site provides detailed profiles of top-rated car accident attorneys in Houston, including their experience, areas of expertise, and client reviews."Our goal is to simplify the process of finding expert legal representation for car accident victims in Houston," said Robbie Allen, founder of Car Accident Lawyer Houston. "We understand that dealing with the aftermath of an accident can be overwhelming, so we've created a one-stop resource to connect people with skilled attorneys who can help them navigate the complex legal system and fight for the compensation they deserve."The website also offers valuable information on car accident laws in Texas, tips for what to do after an accident, and answers to frequently asked questions. Visitors can request free consultations directly through the site.Car Accident Lawyer Houston is committed to helping accident victims in the Greater Houston area protect their rights and receive fair compensation for their injuries and losses. TThe new website is now live and accessible to all residents of Houston and surrounding communities.For more information, visit Car Accident Lawyer Houston. Fight back with a Houston car accident lawyer if you're injured in a crash. Car Accident Lawyer Houston; Best of all, there are no upfront costs and you do not pay unless we win. That’s because Car Accident Lawyer Houston represent our clients on a contingency fee basis. Media Contact Organization: Car Accident Lawyer Houston Contact Person: Robbie Allen Website: https://caraccidentlawyerhouston.com/ Email: Send Email City: Houston State: Texas Country:United States Release id:16919

Kreativstorm Unveils Comprehensive New Guide for Aspiring Pr...

Berlin, Germany, 2nd Jul 2024 - Kreativstorm, a leading name in innovative educational solutions, proudly announces the release of its latest guide aimed at helping individuals enhance their career prospects. This new guide is designed to offer invaluable insights and practical advice for anyone looking to invest in their education through online courses with certificates.As the job market becomes increasingly competitive, the importance of continuous learning and upskilling cannot be overstated. Kreativstorm's new guide highlights the myriad benefits of taking online courses with certificates, emphasizing how such credentials can help individuals stand out to potential employers, particularly in high-demand fields.Online learning has revolutionized the approach to education, providing flexibility and access to a wealth of knowledge at one's fingertips. Kreativstorm’s guide delves into the various types of online courses available, from short-term workshops to comprehensive degree programs. It offers a detailed roadmap for selecting the right courses, ensuring that learners make informed decisions that align with their career goals.Investing in education is more crucial than ever. Kreativstorm's guide not only covers the academic and professional advantages of online learning but also provides tips on balancing studies with other commitments. The guide underscores the importance of time management, setting realistic goals, and staying motivated throughout the learning journey.One of the standout features of Kreativstorm’s guide is its focus on the practical application of skills learned. The guide includes case studies and testimonials from individuals who have completed online courses and leveraged their new skills to secure better job opportunities. These real-life examples serve as a source of inspiration and proof that investing in education pays off.Kreativstorm's commitment to empowering learners is evident in the comprehensive nature of this guide. It addresses common concerns about online learning, such as the credibility of certificates and the recognition of online qualifications by employers. The guide reassures readers that accredited online courses from reputable institutions are highly valued in the job market.In addition to providing insights into the benefits of online learning, the guide also offers practical advice on how to finance education. It explores various funding options, including scholarships, grants, and employer-sponsored programs. By removing financial barriers, Kreativstorm aims to make education accessible to all.The new guide is a valuable resource for anyone looking to advance their career through continuous learning. Whether a recent graduate, a mid-career professional, or someone looking to make a career change, Kreativstorm’s guide provides the tools and knowledge needed to navigate the world of online education successfully.Kreativstorm's training programs are designed to cater to a diverse audience, offering courses in fields such as technology, business, healthcare, and more. The guide emphasizes the importance of choosing programs that are relevant to current industry trends and demands. By aligning educational pursuits with market needs, learners can enhance their employability and career growth prospects.Kreativstorm invites all aspiring professionals to explore the training programs and take advantage of the new guide. By investing in education and earning valuable certificates, individuals can stand out from the competition and secure high-demand positions in their chosen fields. The guide is available on Kreativstorm’s website, providing easy access to anyone interested in enhancing career prospects.About Kreativstorm is a pioneering leader in the field of innovative educational solutions, dedicated to empowering individuals through comprehensive and accessible learning opportunities. The mission is to bridge the gap between traditional education and modern career demands by offering high-quality online courses and training programs. With a focus on practical skills and industry relevance, Kreativstorm equips learners with the tools needed to excel in today’s competitive job market. Committed to fostering a community of lifelong learners and professionals, Kreativstorm provides resources that enable personal and professional growth. Explore the diverse range of programs and take the next step in a career journey with Kreativstorm. Media Contact Organization: Kreativstorm Contact Person: Piot Reks Website: https://www.kreativstorm.de/ Email: contact@kreativstorm.de Contact Number: +4921136870044 City: FriedrichstraBe State: Berlin Country:Germany Release id:13737

US Visa Online Transforms Visa Application Process for Swiss...

United States, 28th Nov 2024 - For travelers from Switzerland, Slovakia, and Slovenia planning a trip to the United States, the process of obtaining a visa has just become simpler, faster, and more efficient. US Visa Online offers an innovative and user-friendly platform that streamlines the entire visa application process. With the growing demand for easy access to travel documentation, this service allows citizens from these countries to apply for their US Visa with ease, ensuring a hassle-free experience from start to finish.Key Features and Benefits of US Visa OnlineSimple, Fast, and Secure Online Application ProcessApplying for a US Visa for Swiss Citizens, US Visa for Slovak Citizens, or US Visa for Slovenian Citizens has never been easier. The US Visa Online platform offers a fully digital application process that eliminates the need for physical paperwork, long queues at embassies, and waiting times. Travelers can apply anytime, anywhere, with just a few clicks, and expect quick results. The streamlined process ensures that applicants can complete their application swiftly, saving valuable time.ESTA Application for Eligible TravelersTravelers from Switzerland, Slovakia, and Slovenia can take advantage of the ESTA (Electronic System for Travel Authorization) option if they are visiting the US for short-term stays (business or tourism). The US Visa Online service helps determine eligibility and simplifies the process for applying for ESTA, making it a breeze for eligible travelers to receive authorization for travel to the United States without the need for a visa.24/7 Dedicated Customer SupportOne of the standout features of US Visa Online is its exceptional customer support. The US Visa Help Desk is available 24/7 to assist travelers from Switzerland, Slovakia, and Slovenia at every stage of the application process. Whether applicants have questions about visa eligibility or need help with filling out forms, the support team is ready to provide clear, step-by-step guidance, ensuring a seamless experience for all applicants.Quick and Easy Next Steps After ApplicationOnce the application is completed, travelers are guided through the next steps, ensuring that they know exactly what to expect. Whether it's scheduling a visa interview, submitting additional documents, or preparing for their trip, US Visa Online ensures that applicants from Switzerland, Slovakia, and Slovenia have the necessary tools and information to proceed with ease.Secure Payment OptionsThe platform also offers secure payment options, allowing travelers from all three countries to pay their application fees safely. With multiple payment methods available, applicants can complete the visa application process in a secure and convenient manner.Customer Testimonials"Applying for a US Visa for Swiss Citizens through US Visa Online was a smooth experience. The online process was quick, and the customer service team was always available to assist me when needed. I highly recommend it!" – Luca M., Switzerland"As a business traveler from Slovakia, I needed to get my visa quickly, and US Visa Online made it happen. The platform is straightforward, and I received my approval in just a few days. Excellent service!" – Eva K., Slovakia"I was traveling to the US for a vacation and found the US Visa Online platform so easy to use. The process was fast, and the support team answered all my questions about the next steps after applying for my visa. I’ll definitely use it again!" – Marko P., SloveniaAbout US Visa OnlineUS Visa Online is a leading platform that provides an innovative and efficient way to apply for a US visa online. The service was designed to simplify the traditionally complicated visa application process, making it faster, more convenient, and accessible for travelers worldwide. With a focus on customer satisfaction, US Visa Online ensures that applicants from countries like Switzerland, Slovakia, and Slovenia can easily obtain their US visas or travel authorization via ESTA.The platform offers support for various visa types, including tourist visas, business visas, ESTA applications, and emergency visas. With a commitment to making international travel more accessible, US Visa Online has transformed the visa application process for countless travelers across the globe.For more information or to start the application process, visit US Visa Online.US VISA FOR Swiss CitizensUS VISA FOR Slovak CitizensUS VISA FOR Slovenia CitizensUS VISA HELP DESKHOW TO APPLY US VISA Media Contact Organization: US Visa Online Contact Person: Milan Wheeler Website: https://www.usvisa-online.org/visa Email: Send Email Contact Number: +12487620356 Country:United States Release id:20564

News Shop Group Expands Laverne Collection with Launch of La...

News Shop Group Launches Laverne Sense Perfume at Topshop in Manama, BahrainBahrain, Manama – September 30, 2024 – News Shop Group is an emerging technology firm in the Middle East. In the recent development, the company announces the launch of its latest fragrance, Laverne Sense, now available at the Topshop store in Manama. This new addition to the prestigious Laverne collection promises to enchant fragrance enthusiasts with its luxurious and sophisticated scent profile.The opening of Laverne Sense marks a significant milestone for the Laverne brand, which has consistently captivated customers with its exquisite offerings. Following the tremendous success of the popular “Miss Laverne” perfume, the new Laverne Sense collection further solidifies the brand's reputation for delivering high-quality, captivating fragrances.Laverne Sense showcases an intricate composition that is sure to impress. The fragrance opens with a refreshing top note blend of mandarin, papaya, jasmine, and violet leaves, leading into a heart that beautifully marries rose, pear, and lily of the valley. The scent is anchored by a warm and inviting base of sandalwood, cashmeran, and musk, creating a harmonious and enduring aroma.In addition to Laverne Sense, the collection features a variety of other enchanting fragrances. Notably, the original “Miss Laverne” boasts an enticing blend of black currant and mandarin in its top notes, complemented by a floral heart of jasmine and iris, rounded out with a warm musk base. Each fragrance in the Laverne line is meticulously crafted, appealing to a diverse range of scent preferences.Khaled Alraweli, the contact person for News Shop Group, expressed excitement about the new launch. They are proud to introduce Laverne Sense to their customers in Bahrain. This fragrance not only embodies luxury and elegance but also represents their commitment to offering the highest quality products.For those seeking an extensive selection, Topshop also features a variety of other renowned perfume brands ensuring that customers can find the perfect fragrance for any occasion. To celebrate the launch, customers can enjoy a special discount with the code “Mt5” when purchasing Laverne Sense.About the Company - News Shop Group:News Shop Group is a technologically advanced company established in the Middle East, providing some integration of news and shopping. The new-age platform designed by this company gives users an efficient experience with the latest updates on news, integrated with an interactive shopping environment. A pioneering concern, News Shop Group is constantly enlarging its digital services to meet the growing needs of business by developing high-tech solutions in website designing, social media, and digital marketing.For further details and updates, interested viewers can visit the following link: https://Smart7line.net and Topshop store. Media Contact Organization: News Shop Group Contact Person: KHALED ALRAWAELI Website: https://Smart7line.net Email: Send Email Contact Number: +97334394429 Address:Middle East City: Bahrain State: Manama Country:Bahrain Release id:17605

App Developer Edinburgh: Erbo To Invest £1 Million in Cuttin...

In a bold and strategic move to strengthen its technological capabilities and industry leadership, Erbo, Scotland’s leading app development agency based in Edinburgh, has announced an impressive investment exceeding £1 million in state-of-the-art technology. This significant initiative underscores the company’s unwavering commitment to innovation, excellence, and customer satisfaction in the fast-evolving digital landscape. Edinburgh, Scotland, United Kingdom, 21st May 2024 – In a bold and strategic move to strengthen its technological capabilities and industry leadership, Erbo, Scotland’s leading app development agency based in Edinburgh, has announced an impressive investment exceeding £1 million in state-of-the-art technology. This significant initiative underscores the company’s unwavering commitment to innovation, excellence, and customer satisfaction in the fast-evolving mobile app development landscape. Elevating App Development Technological InfrastructureThe substantial investment will be directed towards the integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Vision Pro Technologies into Erbo’s development processes. By adopting these cutting-edge technologies, the company aims to enhance the functionality, security, efficiency, and user experience of the apps they develop. “At Erbo, our mission is to stay ahead of the curve in app development,” said the Erbo team. “This investment is a testament to our commitment to providing our clients with the most advanced and innovative solutions available, ensuring they remain competitive in their respective markets.” Expanding App Developers Talent and ExpertiseIn addition to upgrading its technological infrastructure, Erbo plans to expand its team of app experts. The company is focused on attracting top-tier talent in app development, user experience design, security, and other critical areas. This expansion is crucial for maintaining the company’s competitive edge and ensuring the delivery of high-quality, customised solutions tailored to the unique needs of their diverse clients across Scotland, and internationally. “We believe that investing in both cutting-edge tools and exceptional talent is essential to maintaining our leadership in the industry,” added the Head of Development at Erbo. “By combining state-of-the-art technology with the expertise of our talented team, we can continue to exceed our clients’ expectations and set new standards in app development.” Fostering App Development Innovation and ResearchThe investment will also bolster Erbo’s research and development (R&D) efforts, fostering a culture of continuous innovation. This focus on R&D will enable the company to explore new ideas, develop pioneering solutions, and stay ahead of emerging industry trends. The enhanced R&D capabilities will drive the creation of more sophisticated and user-friendly applications, further cementing Erbo’s position as a leader in the app development sector. Collaborating with App Investors and the Local Tech EcosystemAs part of its commitment to the local tech community, Erbo will strengthen its collaborations with investors, universities, and tech hubs in Scotland. These partnerships will help nurture the next generation of tech talent and contribute to the growth of the local tech ecosystem. By sharing knowledge and resources, Erbo aims to foster an environment of innovation and excellence within the community. “Scotland has a vibrant and dynamic tech scene, and we are proud to be a part of it,” said Erbo. “Through our collaborations and investments, we hope to contribute to the growth and success of the local tech industry, while also benefiting from the wealth of talent and innovation that Edinburgh and Scotland has to offer.” Enhancing Client-Centric InnovationsIn line with its tradition of delivering client-centric solutions, Erbo will leverage this investment to develop cutting-edge apps that are highly customisable and scalable, addressing the specific needs of businesses across various industries. The new technologies will enable the creation of more intuitive, engaging, and efficient mobile apps, ensuring that clients can achieve their digital goals with ease. “Our clients are at the heart of everything we do,” said Erbo. “This investment allows us to deliver even more personalised and effective mobile solutions, helping our clients to succeed in their digital transformations.” Empowering Businesses with Advanced Cutting-Edge Mobile AppsWith this investment, Erbo is poised to empower businesses with advanced mobile apps that drive growth and innovation. The agency’s enhanced technological capabilities will facilitate the development of mobile apps that streamline operations, improve customer engagement, and provide valuable insights through data analytics. “We are dedicated to helping businesses leverage the power of mobile technology to achieve their goals,” said app developer Erbo. “Our enhanced capabilities will enable us to deliver solutions that not only meet but exceed the expectations of our clients.” Commitment to Sustainability and Ethical PracticesIn addition to technological advancements, Erbo remains committed to sustainability and ethical practices. The company plans to incorporate eco-friendly practices into its operations and app development processes, ensuring that their technological advancements do not come at the expense of the environment. “We recognise the importance of sustainability in today’s world,” said Erbo. “Our goal is to innovate responsibly, balancing technological advancement with environmental stewardship.” Future Outlook and VisionLooking ahead, Erbo envisions a future where technology seamlessly integrates into every aspect of life, enhancing the way we live and work. The company’s investment in advanced cutting-edge technologies is a step towards realising this vision, paving the way for groundbreaking developments in mobile app technology. “We are excited about the future and the possibilities that lie ahead,” said Erbo. “Our investment in mobile app technology is just the beginning. We are committed to continuous innovation and excellence, and we look forward to what the future holds for Erbo and our clients.” App Developer Edinburgh Based in Edinburgh, Scotland, Erbo is the leading app development agency in Scotland specialising in creating cutting-edge mobile apps. Known for its innovative approach and unwavering commitment to quality, Erbo delivers state-of-the-art app solutions to a global clientele, helping businesses achieve their digital aspirations. With a focus on continuous improvement and client satisfaction, Erbo stands at the forefront of the app development Edinburgh industry. Media Contact Organization: Erbo Contact Person: Erbo Website: https://www.erbo.uk Email: Send Email Contact Number: +441315104314 Address: 93 George St City: Edinburgh State: Scotland Country: United Kingdom Release Id: 21052412383 The post App Developer Edinburgh: Erbo To Invest £1 Million in Cutting-Edge App Development Technology appeared first on King NewsWire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

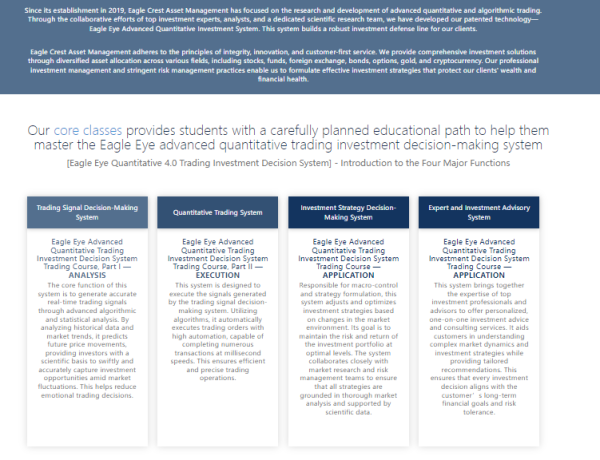

Indira AI Quantitative Platform

Colorado, United States, United States, 30th Nov 2024 - The company is actively preparing to launch global individual investor business and is committed to expanding the Asia-Pacific market to promote business growth and international development.Indira AI Quantitative Platform, an innovative platform focusing on applying cutting-edge artificial intelligence technology to quantitative investment, is jointly created by First Round Capital, Index Ventures, Silicon Valley Angel Investment Fund and Extreme Capital. The cumulative investment scale of the venture capital fund exceeds US$50 million.Indira AI Quantitative Platform innovates the financial investment model through AI and blockchain technology. Indira AI Quantitative Platform is a global private business platform with a US MSB digital currency license. It issues IT tokens to fairly distribute profits and promote the sustainable development of the financial ecosystem.Indira AI Quantitative Platform has successfully entered the Asian market and established branches in Thailand and Malaysia. Although the Chinese market has not yet officially opened, this pace of global expansion undoubtedly demonstrates its huge potential.Indira AI Quantitative Platform currently has a large number of members in Australia, Russia, Spain, Dubai and Taiwan, China, and is gradually building a global quantitative financial ecosystem.Three main businesses1. Cryptocurrency market2. Stock and foreign exchange market3. Precious metals marketIn 2016, Indira AI Quantitative Platform has been developing AI automatic quantitative trading strategies and has trained a large number of trading models. Indira AI Quantitative Platform has been focusing on enterprise-level business and will not be open to individual investors until May 2024. Behind this strategy is the company's commitment to building the world's top professional aggregation platform for AI intelligent trading prediction and copy trading, which has achieved initial results.Indira AI Quantitative Platform is committed to building the world's leading AI quantitative + blockchain financial ecosystem, welcoming the era of intelligent investment with investors, creating brilliance together, and writing a new chapter of wealth. Media Contact Organization: Indira Trus Contact Person: Alexander Carter Website: http://indiratrus.com Email: Send Email Address:1225 17TH St city: Denver state: Colorado City: Colorado State: United States Country:United States Release id:20695

Oklahoma City Truck Accident Lawyer Launches New Website to...

Oklahoma City, United States, 24th Aug 2024 – In response to the increasing demand for legal guidance following truck accidents, Oklahoma City Truck Accident Lawyer is proud to announce the launch of their new website. This platform is designed to provide valuable information to individuals involved in truck accidents, helping them understand the crucial steps to take immediately after an incident and when it is essential to hire a lawyer.The newly launched website offers a comprehensive resource for accident victims, detailing the critical actions to take post-accident, such as calling 911, seeking immediate medical attention, and collecting essential information from the scene. It also highlights the importance of consulting with a qualified attorney to navigate the complex legal landscape and maximize potential compensation."We understand the devastating impact a truck accident can have on individuals and their families," said Brad W. Wicker, a leading attorney at Oklahoma City Truck Accident Lawyer. "Our new website is a testament to our commitment to providing accessible and reliable information to those in need. We aim to empower accident victims with the knowledge they need to make informed decisions about their legal rights and options."The website also addresses common tactics used by insurance companies to undervalue or deny claims and emphasizes the importance of legal representation in such scenarios. With detailed sections on liability, evidence collection, and the benefits of hiring a specialized truck accident lawyer, the site serves as a vital tool for those seeking justice and fair compensation.For more information, visit the Oklahoma City Truck Accident Lawyer website or contact their office for a free consultation.Oklahoma City Truck Accident Lawyer405-704-3249 Media Contact Organization: Oklahoma City Truck Accident Lawyer Contact Person: Brad W. Wicker Website: https://oklahomacitytruckaccidentlawyer.com/ Email: Send Email Contact Number: +14057043249 City: Oklahoma City Country:United States Release id:16137

Blombard: Revolutionizing Crypto Finance with Innovative Len...

Krasnodar, Russia, 7th Mar 2024 – Blombard, a leading name in the crypto finance industry, has officially launched its innovative crypto lending platform, offering users a seamless and secure way to borrow and lend cryptocurrency assets. Blombard’s platform is designed to meet the growing demand for flexible and user-friendly crypto lending solutions. With Blombard, users can borrow stable coins against their crypto assets, providing them with access to liquidity without having to sell their holdings. Additionally, users can also become lenders on the platform, earning interest by providing liquidity to borrowers. “We are thrilled to announce the launch of Blombard,” said Andrey Vladimirovich, CEO of OOO Lombard Bogatir. “Our platform is designed to empower users in the crypto community by providing them with the tools they need to maximize the potential of their crypto assets. Whether you’re a trader looking to leverage your holdings for margin trading or a long-term holder in need of liquidity, Blombard offers a comprehensive solution tailored to your needs.” Key features of the Blombard platform include customizable interest rates, instant loan approval, and enhanced security measures to protect users’ assets. The platform also offers extended loan durations, providing borrowers with greater flexibility when managing their lending activities. Blombard aims to revolutionize the crypto finance landscape by providing users with a reliable and efficient platform for accessing liquidity and earning passive income. With its user-centric approach and commitment to innovation, Blombard is poised to become a leader in the rapidly evolving crypto lending industry. For more information about Blombard and its innovative crypto lending platform, visit https://blombard.com. About Blombard:Blombard is a leading name in the crypto finance industry, offering users a seamless and secure way to borrow and lend cryptocurrency assets. With its innovative platform and user-centric approach, Blombard is revolutionizing the way people access liquidity and earn passive income in the crypto market. Media Contact Organization: OOO Lombard Bogatir Contact Person: Andrey Vladimirovich Website: https://blombard.com Email: andrey@blombard.com City: Krasnodar Country: Russia Release Id: 07032410288 The post Blombard: Revolutionizing Crypto Finance with Innovative Lending Solutions appeared first on King NewsWire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

Birdfy Unveils Next-Gen Smart Bird Feeder With Camera 5G For...

Los Angeles, California, United States, 29th Oct 2024 - Birdfy, the renowned pioneer in providing advanced devices to observe the avifauna, proudly presents its cutting-edge invention—the smart bird feeder with camera 5g, Birdfy Feeder 2 Pro. Through a few simple steps below, bird watchers can connect with their favorite intelligent bird feeder and get an unprecedented view of the wildlife with breathtaking clarity. A high-definition 5G camera, combined with Artificial Intelligence, means creating a product that allows people interested in birds and nature and generally curious to observe Nature practically.This bird feeder camera is linked to bird watching, which has always been a timeless practice. Technological features have enhanced bird observation to make it more precise, convenient, and engaging. As 5G technology allows for a live broadcast of footage from anywhere in the world through a smartphone, people can watch birds go about their daily routines in real time and, with absolute quality, a whole new level of interaction with wildlife.Birdfy and its team aim to ensure a connecting link between technology and nature. Moving on, the Smart Bird Feeder with Camera 5G gives birdwatching enthusiasts a new way to be more immersed in wildlife. The latest technological developments in wireless connectivity, imaging, and artificial intelligence have been bundled into creating a product that makes what comes naturally enjoyable and easily accessible for the users.Bringing Nature Closer With 5G ConnectivityThe 5G technology in the Birdfy Smart bird feeder camera allows it to stand out from other bird feeders and well-established intelligent gadgets. In the past, bird feeders with cameras utilized Wi-Fi connectivity, which has inherent signal strength, distance, and stability constraints. These challenges are countered with the Birdfy feeder utilizing 5G connectivity, which offers the feeder a quick, steady, and incredibly responsive connection.With 5G, people can stream high-definition video virtually anywhere and use it to document the birds that come to the feeder. This feature allows users to put their bird feeder in different urban, suburban, or rural settings, get real-time video feeds and alerts, and never miss any moment.HD Camera: Capturing Wildlife With Unmatched ClarityThe most important feature of this bird feeder camera is its high definition, which ensures that users get a clear view of the birds visiting this feeder. They come with 1080P HD cameras for clear and detailed video and audio feed, and it follows that even the details on the feathers, the beak, and the wings are recorded in fine detail. Regardless of the bird, people might be watching; whether it is a daily visitor in the backyard or a migratory bird they have rarely come across, the quality of the camera ensures that bird watching feels almost as if the bird is produced by technology in living reality.Another feature of the Birdfy Feeder 2 Pro is that its camera cannot only provide video feedback in the daytime but can also see in the dark. Bird activity persists even beyond the dark, and now, with infrared technology, the feeder cam shall still be active at night without losing a clear image. This feature is especially useful to those interested in the night activities of some bird species. It might be preferable for those who would like to be accompanied by the company of birds at any time of the day.Furthermore, it encompasses provisions for shooting under different lighting conditions. When the sun is high, or clouds are hanging on the view, the camera soon changes its settings to let the viewer see what is happening. For nature lovers who like to record their observations, Smart Feeder is ideal for recording birds and sharing these moments with friends or social media groups.AI-Powered Bird Identification: Learn As WatchThis bird identification system is another unique feature that makes the Birdfy Smart Bird Feeder with camera 5G one of the best in the market. It is not just the feeder for observing birds but for getting knowledge from every encounter. With the help of modern machine learning, feeders can recognize and name different species of birds when they arrive. This feature provides a learning factor to bird watching and dispels the challenge of knowledge of the many species of birds within the area to novice bird watchers.When birds approach the feeder to perch or feed, the AI system compares the video stream's size, colors, and other characteristics to a database containing a broad array of bird varieties. Once recognized, the app alerts the user’s smartphone and offers more elaborate information on the bird and its natural environment and behavior patterns. This assists the users in appreciating birdlife and makes bird watching a more informative grind.Motion Detection And Instant AlertsThe Birdfy Feeder 2 Pro is intended to notify and entertain users, even if they don’t monitor the feed in real-time. With modern motion sensors, the bird feeder camera ‘sees’ when a bird is there, and an instant message appears on the user’s mobile device. This way, those interested in birds can visit frequently, even if they may be occupied or out of town.The motion detection feature is very sensitive and will not be tripped by wind or anything other than a bird’s movement; thus, users will be updated only on important changes. Once a bird is identified, the system records its video, which can be recorded for later use or relayed immediately. This feature is handy for people who do not have the time to check the feeder frequently but want to know what is happening around their compound.A New Standard In Birdwatching TechnologySince Birdfy developed the Smart Bird Feeder with Camera 5G, bird watching has always been different. Powered by the newest connectivity, imaging, and artificial intelligence technologies, this feeder provides the unique feeling of surrounding oneself with nature’s scenes. Whether wildlife observation is a practice or a new and developing enthusiasm for the specific consumer, the Birdfy Feeder 2 Pro is an improvement and development that will significantly enrich one’s experience.About BirdfyBirdfy is a well-known company specializing in developing and producing bird care items around the world, and their mission is to help people far better understand and appreciate nature. Media Contact Organization: Birdfy Contact Person: Yeze Li Website: http://www.birdfy.com/ Email: content@birdfy.com Address:Los Angeles, California City: Los Angeles State: California Country:United States Release id:19076